Australian startup funding is witnessing a vibrant surge, with innovative companies in diverse sectors securing significant capital to fuel their ambitions. This week, the spotlight is on a Melbourne-based medtech company, a promising fintech venture, and a groundbreaking healthtech startup, showcasing the dynamic investment landscape of startup funding Australia. Noteworthy investments, like the $40 million secured by Seer Medical and the $12 million raised by WeMoney, illustrate the growing interest in fintech news Australia and the potential for these sectors to transform the market. Investors are increasingly looking to back companies that integrate technology with finance and healthcare, as exemplified by the latest WeMoney funding announcement aimed at enhancing financial wellness for Australians. As these startups attract attention, they signal a robust appetite for innovative solutions that can shape the future of healthcare and finance in Australia.

In recent weeks, the realm of financial backing for budding enterprises in Australia has demonstrated an exhilarating shift. With leading-edge companies in healthtech and fintech sectors making headlines, we are observing a notable trend in startup financing, especially within the context of medtech investment. The ongoing flow of capital into ventures like Superpower and Seer Medical reflects the growing demand for advanced solutions in wellness and technology, emphasizing how critical investment strategies are to the development of health-related innovations. Additionally, as organizations mobilize resources, the spotlight on financial tech developments in Australia reinforces the evolving nature of personal finance management. This energetic environment sets the stage for startups to thrive, enriching the overall landscape of entrepreneurial opportunities.

The Evolution of Startup Funding in Australia

Startup funding in Australia has witnessed significant advancements over the past decade, making the country a vibrant hub for innovation and entrepreneurship. Not only are there increased government initiatives aimed at supporting startups, but there is also a growing interest from private investors and venture capitalists looking to tap into the thriving Australian market. With the rise of ecosystems in cities like Sydney and Melbourne, startups of all kinds—from fintech to healthtech—are finding ample resources to fuel their growth, leading to a surge in groundbreaking solutions.

One notable trend in Australian startup funding is the escalating influx of capital into sectors such as medtech and fintech. This week highlights three key funding announcements that underscore this trend, with companies like Seer Medical and WeMoney leading the charge. They exemplify how targeted investments can significantly strengthen a startup’s capacity to scale and innovate, ultimately benefiting the broader economy and society at large.

How Seer Medical’s $40 Million Investment is Reshaping Medtech

Seer Medical’s recent capital infusion of $40 million marks a pivotal moment for the medtech landscape in Australia. By securing investments from notable sources such as Cadwell Industries and Breakthrough Victoria, the company is positioned to advance its cutting-edge at-home clinical monitoring systems. This funding will not only help Seer streamline its operations following a restructuring but also enhance its product offerings, ultimately leading to better patient outcomes in the management of neurological conditions like epilepsy.

The partnership with established investors ensures that Seer Medical can leverage their expertise and resources, further reinforcing its dedication to innovation. It sets a strong precedent for other healthtech startups seeking funding in Australia, demonstrating that strategic collaboration can lead to tangible results. As demand for such innovative health solutions grows, the spotlight on medtech investments highlights the importance of nurturing and financing startups that address critical healthcare challenges.

WeMoney’s Major Leap in Fintech Funding

WeMoney’s recent fundraising round, where it raised $12 million, illustrates the rising trend of fintech innovations in Australia. The backing from major investors like Mastercard underscores the potential this Perth-based startup has to revolutionize personal finance management through technology. By integrating open banking and AI-driven tools into its platform, WeMoney is poised to reshape how Australians approach their financial health.

This investment not only highlights investor confidence in WeMoney but also signals a broader trend—fintech startups are gaining traction as essential players in Australia’s economic landscape. With the ongoing development of the Consumer Data Right framework, WeMoney can offer its users enhanced visibility and control over their finances, further solidifying its place within the fintech news cycle. As these technologies evolve, they promise to deliver smarter, more user-friendly financial solutions that cater to the diverse needs of Australian consumers.

Superpower’s Ambitious Goals with $47 Million Series A Funding

Superpower’s recent $47 million Series A funding success reveals the ambitious plans of many emerging healthtech startups in Australia. With the backing of prominent investors and celebrities, this San Francisco-based startup aims to disrupt traditional healthcare systems by integrating diagnostics and data tracking into a seamless user experience. The global health super-app vision is indicative of how technology can reshape personal health management and early detection strategies.

Fundamental to Superpower’s mission is the emphasis on preventive care through advanced biomarker testing, a direction that resonates strongly with today’s healthcare needs. This funding not only fuels Superpower’s development but is also a testament to the growing investor interest in healthtech innovations, mirroring trends seen in medtech funding during the week. As it seeks to achieve a $200 million valuation, Superpower represents the potential and aspirations of the next-generation health startups emerging from Australia and beyond.

Navigating Australian Startup Ecosystem: Challenges and Opportunities

The Australian startup ecosystem is ripe with potential but is not without its challenges. Startups often face the daunting task of securing funding amidst competitive pressures and rapidly evolving market demands. Despite these hurdles, the climate for startup funding in Australia continues to improve, thanks to a mixture of government support initiatives and a growing network of angel investors and venture capitalists. These factors collectively enhance the prospects for emerging businesses in areas such as fintech and healthtech.

Opportunities are abundant for startups, particularly those that align with current technological and societal needs. Recent funding announcements, such as those from Seer Medical and WeMoney, show how innovative business models can attract substantial capital. This spotlight on Australian startups indicates a promising future for entrepreneurs willing to engage with the ecosystem and leverage opportunities for growth and development.

The Role of Celebrity Investors in Australia’s Startup Scene

The increasing involvement of celebrity investors in Australia’s startup scene is changing the game for early-stage companies. High-profile individuals, such as those backing Superpower, bring not only financial capital but also invaluable connections and market exposure that can leapfrog a startup’s growth trajectory. This kind of visibility is particularly advantageous for healthtech startups looking to attract attention and investors given the increasing public interest in health innovation.

Moreover, the engagement of celebrities can bridge the gap between traditional investment routes and emerging startups by drawing in retail investors and raising awareness about innovative products. As more celebrities show interest in the tech space, startups can benefit from an amplified marketing reach, making the case for funding more appealing to potential investors across various sectors, including medtech and fintech.

Future Trends in Australian Startup Investments

As we look towards the future of startup investments in Australia, a few key trends are likely to shape the landscape. Firstly, the emphasis on sustainability and social impact is resonating with both investors and consumers. Startups that focus on social good while operating within profitable business models are expected to draw in more funding. Additionally, the surge in digital transformation across sectors such as finance and healthcare is likely to fuel investor interest in innovative technologies and platforms.

Another trend worth noting is the collaboration between startups and established enterprises. Partnerships that leverage shared resources can create powerful synergies, helping startups scale more rapidly and effectively. As seen with Seer Medical and WeMoney, collaborations can provide young companies with the infrastructure they need to succeed while offering established firms new avenues for growth and innovation. This dynamic will continue to foster an environment where startups can thrive and attract ongoing capital investments.

The Importance of Networking for Startup Success

Networking plays a critical role in the success of Australian startups, shaping their ability to secure funding, mentorship, and partnerships. The startup ecosystem thrives on relationships; thus, fostering connections with investors, industry peers, and potential customers can greatly enhance a startup’s prospects. Tapping into local entrepreneurial networks or attending funding events can provide startups with critical exposure that leads to investment opportunities.

Moreover, strong networks serve as a support system for startups during challenging times. Feedback and advice from seasoned entrepreneurs or investors can help refine business strategies and improve operational efficiencies. As demonstrated by companies like WeMoney, active engagement with the startup community not only fuels growth through funding announcements but also fosters an innovation-driven culture that encourages collaboration and knowledge sharing.

Leveraging Government Initiatives for Startup Funding

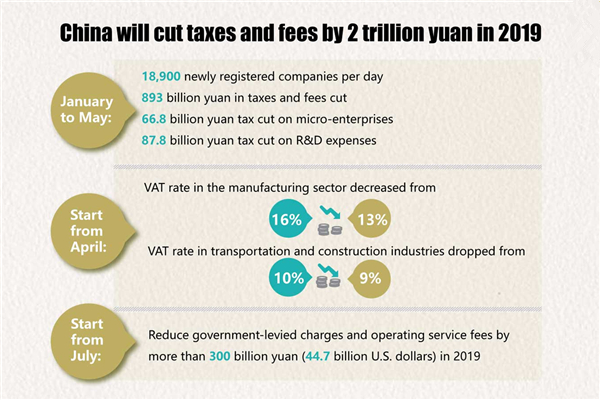

Australian startups have much to gain from various government initiatives aimed at boosting innovation and entrepreneurship. Programs that provide funding, grants, and tax incentives are designed to alleviate some of the financial pressures faced by early-stage companies. Such initiatives are particularly valuable for startups in capital-intensive sectors like medtech and fintech, where high investment is necessary to develop viable products.

Government support can also enhance credibility, making it easier for startups to attract private investment. As we have seen with Seer Medical’s recent funding, partnerships with government-backed bodies like Breakthrough Victoria can lead to successful fundraising rounds. For ambitious entrepreneurs, leveraging these initiatives can be a strategic move, ensuring they have the necessary resources to innovate and compete effectively in the market.

Frequently Asked Questions

What are the latest developments in Australian startup funding for medtech companies?

Recent developments in Australian startup funding have seen companies like Seer Medical securing a $40 million investment to enhance their medtech solutions. This reflects a growing interest in innovative medical technologies within Australia, highlighting the potential for significant growth in the medtech sector.

How is WeMoney contributing to fintech news in Australia with its recent funding announcement?

WeMoney has made headlines in fintech news Australia by raising $12 million in Series A funding to bolster its mission of improving financial wellness. This funding will enable the Perth startup to expand its services, empowering Australians with tools for better financial management through open banking and AI technology.

What role do healthtech startups play in the Australian startup funding landscape?

Healthtech startups like Superpower are playing a pivotal role in the Australian startup funding landscape, particularly with their focus on innovative health solutions. Recent funding rounds indicate a robust interest in health tech innovation, demonstrating how these startups are poised to transform healthcare delivery in Australia.

What innovations are Australian medtech firms bringing to the healthcare market?

Australian medtech firms, exemplified by Seer Medical, are introducing innovations such as at-home clinical monitoring systems. These advancements not only provide crucial diagnostic tools for conditions like epilepsy but also enhance patient care by enabling monitoring in daily environments.

How significant is the growth of fintech in Australia as highlighted by startup funding announcements?

The growth of fintech in Australia is significant, as evidenced by WeMoney’s recent $12 million funding announcement. This reflects a trend towards increasing investment in financial technology, aimed at enhancing consumer finance management through innovative platforms.

What impact do celebrity investors have on healthtech startups in Australia?

Celebrity investors, like those involved with Superpower’s recent funding round, can significantly enhance the visibility and credibility of healthtech startups in Australia. Their involvement not only attracts media attention but also raises investor confidence, leading to increased startup funding opportunities.

What can other Australian startups learn from the recent funding successes in medtech and fintech?

Other Australian startups can learn from recent successes in medtech and fintech by focusing on innovation, building strong investor relationships, and leveraging market trends. The ability to present a compelling case for how their solutions meet modern needs is crucial in securing startup funding.

How does the Australian government support startup funding initiatives?

The Australian government supports startup funding initiatives through programs like Breakthrough Victoria, which plays a role in funding significant medtech projects, such as Seer Medical’s recent investment deal. This type of government support is vital for fostering innovation and growth within the startup ecosystem.

What key factors drive investor interest in Australian healthtech startups?

Key factors driving investor interest in Australian healthtech startups include advancements in technology, the rising demand for digital health solutions, and the potential for scalable models that can improve patient outcomes. Startups like Superpower exemplify these trends, attracting substantial backing as a result.

How does open banking impact startup funding in Australia, specifically for fintech firms?

Open banking significantly impacts startup funding in Australia by creating opportunities for fintech firms like WeMoney to offer innovative financial services. The regulatory framework allows startups to utilize consumer data to develop smarter financial solutions, which in turn can attract investment from major players.

| Key Point | Details |

|---|---|

| Seer Medical Funding | $40 million funding secured from Cadwell Industries, Breakthrough Victoria, and TrialCap to revive medtech firm. |

| WeMoney Funding | Raised $12 million in Series A to enhance financial wellness tools, supported by investors including Mastercard. |

| Superpower Funding | Secured $30 million (A$47 million) for a health platform integrating diagnostics and predictive health tools, attracting celebrity investors. |

Summary

Australian startup funding is gaining momentum as innovative businesses like Seer Medical, WeMoney, and Superpower secure significant investments this week. With an increasing appetite for scalable solutions in medtech and fintech, these funding announcements underscore the robust ecosystem supporting Australian startups. As the government and private sectors collaborate to back such ventures, Australia’s position as a hub for entrepreneurial growth continues to strengthen.