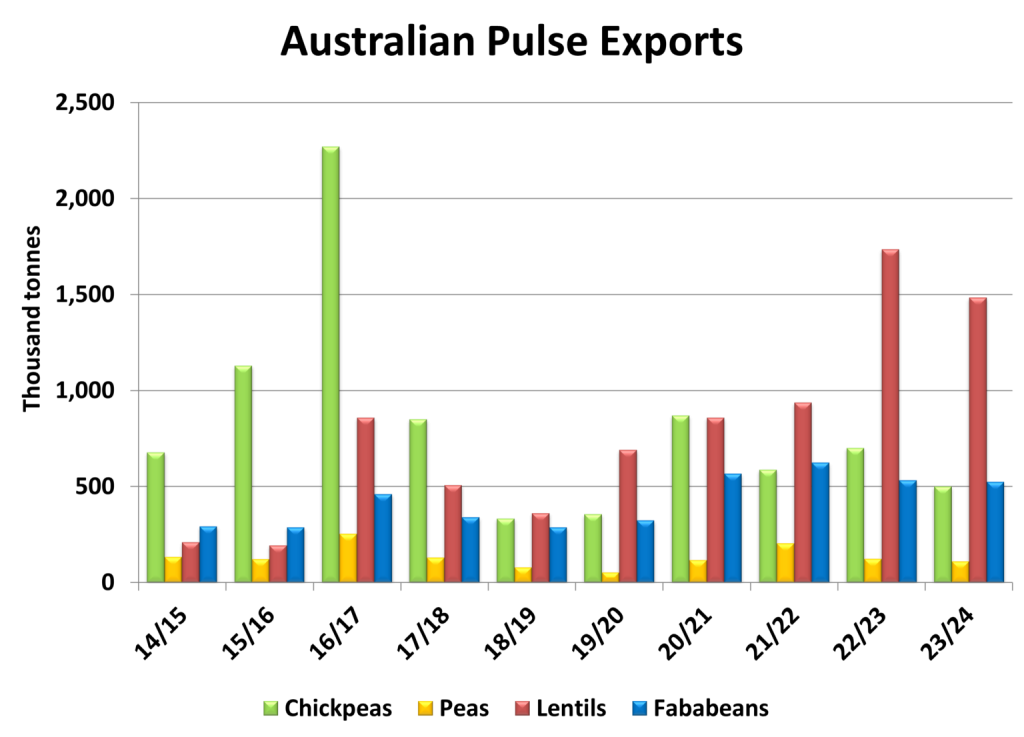

Australian pulse exports have become a crucial component of the nation’s agricultural trade, significantly impacting global markets. This thriving sector primarily consists of chickpeas, lentils, and faba beans, which cater mainly to the robust demand from India and the Middle East. However, recent developments, as highlighted in the Rabobank pulse report, indicate that these exports may face challenges due to fluctuating global supply and demand dynamics. Notably, currency volatility and rising shipping costs are expected to influence farmgate prices and export margins. Nonetheless, the overall outlook remains positive, with Indian demand for Australian pulses serving as a promising pillar for future growth.

The landscape of pulse farming in Australia is experiencing noteworthy shifts, particularly as market trends evolve globally. The exportation of legumes, such as chickpeas and lentils, plays a pivotal role in Australia’s agricultural profile, especially in alignment with India’s rapidly evolving pulse requirements. With increasing pressures on global food supply chains, the Australian pulse industry is positioned to capitalize on favorable conditions despite some emerging trade complexities. As outlined in industry reports, notably the Rabobank assessment, the interaction of tariffs and local demand underscores the resilience of Australian pulse producers amid changing economic environments. Therefore, keeping a pulse on these developments is essential for stakeholders aiming to navigate the intricate dynamics of the pulse export sector.

Overview of Australian Pulse Exports

Australia’s export landscape for pulses, including chickpeas, lentils, and beans, has shown promise but now faces evolving challenges. According to the latest Rabobank report, the outlook for Australian pulse exports indicates a robust demand primarily from regions like India and the Middle East. However, current currency fluctuations and rising shipping costs may impact farmgate prices and export margins. The upcoming year predicts a minor headwind for exporters as global supply and demand dynamics shift, necessitating strategic adaptations to maintain Australia’s competitive edge in the pulse farming sector.

As Australian producers focus on enhancing their pulse farming practices, they will need to closely monitor international trends, particularly concerning key markets such as India. This has been notably influenced by India’s recent trade policies, including a modest 10 percent import tariff on lentils and chickpeas. Despite these tariffs posing potential challenges, the necessity for consistent pulse supply underscores the resilience of Australia’s exporters. Keeping ahead of international developments will be vital for maximizing the benefits of Australia’s strong agricultural base.

Impact of Indian Demand on Pulse Exports

India remains a cornerstone of Australian pulse exports, often characterized by significant demand that outpaces local supply capabilities. Despite challenges such as the implementation of new tariffs, Australia’s pulse exports are likely to thrive given India’s growing need for pulses to bolster food security. Rabobank analysts indicate that increased pulse imports into India, projected to reach 6.7 million tonnes in the 2024/25 financial year, will create ample opportunities for Australian exporters to bridge the supply gap in this rapidly expanding market.

The Rabobank report further highlights the intricate balance between domestic agricultural policies in India and Australian export potential. As India grapples with insufficient pulse supplies to meet rising demand, the strategic timing of Australian exports becomes crucial. Producers must closely observe the dynamics of Indian crop cycles and evolving tariffs to align their offerings with market needs. The demand for Australian chickpeas, lentils, and other pulses remains a key driver for not only export volumes but also for sustaining healthy trade relationships between the two nations.

Trends in Global Pulse Markets

A comprehensive understanding of global pulse market trends is essential for any stakeholder aiming to engage in pulse farming. The Rabobank report sheds light on how geopolitical factors, such as the US-China trade dynamics and Canada’s fluctuating market presence, influence Australia’s standing in the global pulse trade. Considering that the US pulse market remains modest, the opening for Australia becomes apparent. Strengthening existing trade relationships with India and reassessing strategies in response to changing market conditions are pivotal for Australian exporters.

Emerging pulse export trends show a substantial shift away from traditional markets toward those that exhibit a growing demand for sustainable agricultural practices. With Australia’s pulse exports increasingly directed towards Asia, and specifically India, understanding the competitive landscape becomes crucial. The interaction between international tariffs, global market supply and demand fluctuations, and changing consumption patterns necessitates agility in export strategies to capitalize on opportunities presented in these changing environments.

Challenges in the Pulse Export Supply Chain

Navigating the pulse export supply chain presents its own array of challenges, particularly in light of the analyses performed by Rabobank. Issues surrounding logistics, shipping costs, and currency volatility can affect profit margins and the overall viability of exporting pulses from Australia. The recent uptick in shipping fees raises concerns about how logistics networks should adapt to sustain Australian pulse export levels amidst these financial pressures.

To mitigate these challenges, stakeholders in the pulse farming sector must develop strategic partnerships and leverage innovations in agricultural practices and logistics. Optimizing the supply chain further enhances the capacity to respond to sudden shifts in demand or tariffs, thus minimizing disruptions. By focusing on efficiency, the Australian pulse industry can not only maintain its current export volumes but also explore new market opportunities.

The Future of Australian Pulses in Global Markets

Looking ahead, the future of Australian pulses in global markets appears cautiously optimistic. With an emphasis on agricultural innovation and a commitment to addressing global food security needs, Australian exporters are well-positioned to expand their reach. The combination of strategic forecasting and robust engagement with international markets, particularly in the context of rising populations demanding increased pulse imports, may bolster Australia’s export potential in the near future.

The Rabobank report serves as a valuable resource for understanding market expectations and aligning production strategies accordingly. As exporters evaluate the nuances of the global pulse landscape, it is crucial to maintain flexible strategies that respond swiftly to emerging opportunities while navigating barriers such as tariffs and competing nations. Ultimately, Australia’s commitment to sustainable pulse farming will play a significant role in shaping its future both at home and in export markets.

Understanding Pulse Farming Practices

The pulse farming sector in Australia is characterized by a diverse array of crops, including chickpeas and lentils, which are prized not only for their nutritional value but also for their sustainability. Effective pulse farming practices can enhance soil health and contribute to overall agricultural resilience. The interaction of various farming techniques aligned with market demands will be crucial moving forward, as exporters seek to capitalize on both domestic and international trends.

Advantages associated with pulse crops, such as nitrogen fixation, help improve soil quality while providing farmers with sustainable production options. By adopting best practices in pulse agriculture, Australian farmers can achieve higher yields and better meet the needs of export markets. As pulse farming continues to evolve, education and innovation will be essential in maintaining competitiveness and ensuring that Australian pulses meet the growing global demand.

The Role of Shipping in Pulse Exports

Shipping logistics play a pivotal role in the efficacy of Australian pulse exports, influencing timelines, costs, and profitability. Rabobank’s findings underline how rising shipping fees and logistical bottlenecks can affect competitiveness in exporting pulses. As global conditions fluctuate, Australian exporters must adapt their strategies to address potential disruptions, ensuring that pulse shipments remain efficient and cost-effective.

Evaluating shipping routes and collaborating closely with freight partners can optimize the export process. By adopting a proactive approach to logistics management, Australian farmers and exporters can navigate challenges associated with shipping and capitalize on export opportunities. As Australia aims to expand its presence in global pulse markets, the role of effective shipping practices cannot be overstated.

Economic Impacts of Tariffs on Pulse Exports

The economic implications of tariffs on pulse exports, particularly between Australia and key markets like India, warrant careful examination. The Rabobank report emphasizes that while the 10 percent tariff imposed by India on pulses can impact Australian exporters, the overall necessity for imports remains a cornerstone of this trade relationship. Understanding these dynamics can inform how Australian producers strategize around pricing and production levels.

Economic factors, such as inflation and the cost of production, are further compounded by international tariffs that may constrain pricing strategies. As Australian exporters adapt to the tariff landscape, they must also be mindful of maintaining their competitiveness while ensuring food affordability in importing markets. Developing flexible pricing strategies will be key in weathering the economic ramifications of tariffs on pulse exports.

Adapting to Market Volatility in Pulse Exports

The volatile nature of markets poses an ongoing challenge for Australian pulse exporters, demanding agility and resilience in their operational strategies. With changing geopolitical landscapes and fluctuating tariffs, staying informed and prepared to adapt is essential for sustaining competitive advantage. Rabobank’s insight into market dynamics highlights the need for strategic foresight in navigating the complexities of Australian pulse exports.

Monitoring shifts in competitor markets, such as Canada’s changing export policies and the fluctuating demand from countries like India, can provide Australian exporters with critical insights for decision-making. By adopting a forward-thinking approach and leveraging market analytics, the pulse industry can effectively mitigate risks associated with volatility and ensure ongoing engagement with key international buyers.

Frequently Asked Questions

What are the current trends in Australian pulse exports?

Australian pulse exports, including chickpeas, lentils, and faba beans, are currently focusing on demand from India and the Middle East. According to the Rabobank pulse report, these markets are not involved in significant trade conflicts, supporting robust demand for Australian pulses despite potential headwinds related to global supply and currency fluctuations.

How do Australian chickpeas factor into the pulse export market?

Australian chickpeas play a crucial role in the pulse export market, especially towards South Asian markets like India. The Rabobank report highlights that India’s strong demand for chickpeas positions Australia favorably, despite the recent establishment of a 10 percent import tariff on these pulses by India.

What effects do tariffs have on Australian pulse exports to India?

The 10 percent tariff imposed by India on Australian pulses, including lentils and chickpeas, is a challenge but reflects the necessity for imports to meet rising domestic demand. This situation maintains a positive outlook for Australian pulse exports, as India’s insufficient local supply emphasizes the importance of maintaining trade relationships.

What insights does the Rabobank pulse report provide regarding Australian pulse farming?

The Rabobank pulse report suggests that Australian pulse farming remains competitive, particularly due to strong export demand from India. It outlines the need for Australian farmers to adapt to fluctuating global prices and shipping costs while capitalizing on the growing demand in international markets.

How do global shipping costs impact Australian pulse exports?

Global shipping costs are projected to rise, which may affect Australian pulse exports. According to the Rabobank report, Australia’s previous experience with high yields during La Niña conditions has positioned the industry to manage these changes better than other countries, offering a potential advantage despite increased shipping costs.

What is the outlook for Indian pulse imports according to the Rabobank report?

The Rabobank report forecasts a significant increase in Indian pulse imports, potentially reaching 6.7 million tonnes in the 2024/25 financial year. This surge is driven by rising domestic demand and previous years’ local production challenges, thereby bolstering prospects for Australian pulse exports to India.

How do Australian pulses compete with US and Canadian exports?

Australian pulses compete favorably against US and Canadian exports, with Rabobank noting that Canada’s challenges due to tariffs may open up markets for Australian products. Australia exported 4.0 million tonnes of pulses in 2024, surpassing US exports, reinforcing Australia’s strong position in the global pulse trade.

What role does currency volatility play in Australian pulse exports?

Currency volatility is a key factor impacting Australian pulse exports, as highlighted in the Rabobank report. Fluctuations in exchange rates can influence farmgate prices and export margins, making it important for exporters to monitor currency trends to optimize their financial outcomes.

| Key Topic | Details |

|---|---|

| Overall Outlook | Rabobank suggests Australian pulse exports may face minor headwinds due to global supply and demand changes. |

| Key Markets | Australia primarily exports lentils, chickpeas, and faba beans to India and the Middle East. |

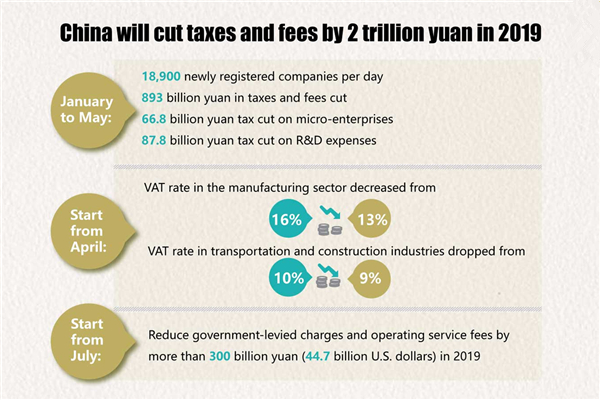

| Impact of Tariffs | China’s 100% tariffs on Canadian peas and India’s 10% tariffs on lentils and chickpeas are shaping trade. |

| Indian Demand | India’s rising demand and insufficient supplies position Australia favorably for exports. |

| US Market Dynamics | US exports are much lower than Australia’s, and Canada’s situation is likely to open up opportunities for Australia. |

| Future Projections | India’s pulse imports could rise to 6.7 million tonnes by 2024/25, a 52% increase year-on-year. |

| Shipping Costs | Potential increases in shipping fees may impact overall pulse markets but Australia is relatively less affected. |

Summary

Australian pulse exports are set to thrive despite global challenges, driven by sustained demand from India and strategic trade relationships. The Rabobank report underscores Australia’s strong position in the pulse market, particularly as Indian demand is projected to increase significantly. With favorable tariff conditions and a robust supply chain, Australian exporters are well-placed to navigate the intricate landscape of global pulse trade in the coming year.