Card payment surcharges have become a significant issue for small and medium enterprises (SMEs) as they navigate the complexities of compliance with Australian regulations. The Australian Competition and Consumer Commission (ACCC) is reminding business owners that these surcharges must accurately reflect the actual costs of acceptance associated with card transactions. Adhering to the ACCC guidelines is crucial, as improper surcharging can lead to penalties and a loss of customer trust. Transparency in surcharge disclosure is not just an obligation but a vital aspect of fostering customer relationships in today’s competitive retail landscape. By understanding the cost of acceptance and ensuring compliance with retail payment regulations, SMEs can better serve their customers and avoid potential legal pitfalls.

In light of increasing scrutiny on payment methods, many are starting to reconsider the practice of imposing fees on card purchases. These fees, known alternatively as surcharges, often raise questions about their legitimacy and fairness to consumers. As small and medium-sized enterprises (SMEs) assess their pricing structures, understanding the financial implications behind these surcharges is essential, particularly in alignment with ACCC regulations. Businesses must take care to ensure that any additional charges correspond accurately to their costs of processing card payments. A thorough examination of these practices can help in not only complying with legal requirements but also in maintaining customer loyalty through transparent pricing.

Understanding Card Payment Surcharges and SME Compliance

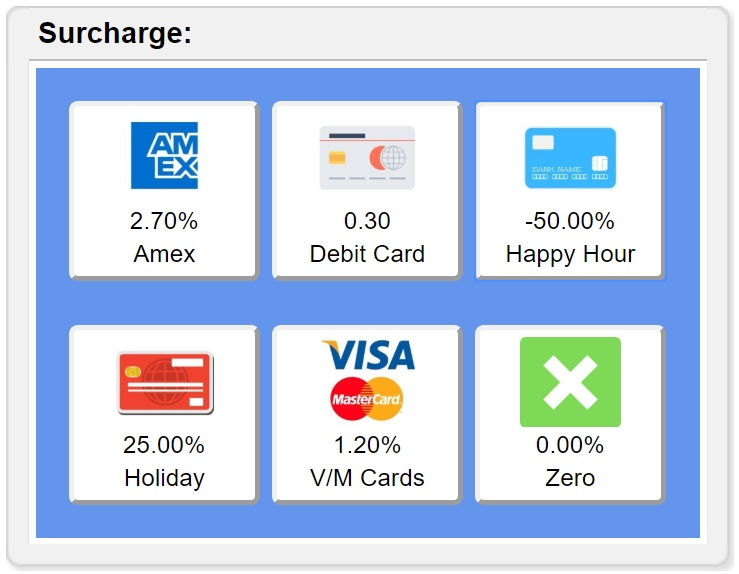

Card payment surcharges represent an additional fee that businesses impose on customers who choose to pay with credit or debit cards. For small and medium enterprises (SMEs), understanding these surcharges is essential not just for compliance with the Australian Competition and Consumer Commission (ACCC) guidelines, but also for maintaining customer trust. The ACCC mandates that these surcharges should reflect the actual ‘cost of acceptance,’ which includes the merchant service fees and any other associated expenses that a business incurs when processing card payments.

Failure to comply with ACCC regulations on surcharging can lead to financial penalties and a damaged reputation. SMEs must take proactive measures, such as accurately calculating their cost of acceptance and ensuring that their surcharge practices align with legal requirements. By understanding the implications of card payment surcharges and adhering to the guidelines, businesses can avoid misleading their customers and foster a more transparent transactional environment.

Importance of Surcharge Disclosure Under Retail Payment Regulations

Disclosure of surcharges is a fundamental aspect of retail payment regulations as outlined by the ACCC. Businesses are required to clearly inform customers about any additional fees associated with card payments before the transaction is completed. This transparency not only fulfills legal obligations but also builds customer confidence by preventing any feelings of deception. Customers should know upfront what fees they will incur, allowing them to make informed choices about their purchases.

Additionally, it is critical for SMEs to implement compliance practices that ensure accuracy in surcharge disclosure. The ACCC has emphasized that excessive surcharging—charging fees that exceed the actual cost of acceptance—is prohibited. SMEs can mitigate this risk by educating their staff and reviewing their payment processing methodologies to guarantee that all surcharges are properly calculated and communicated. Keeping these practices in line with retail payment regulations is not only beneficial for compliance but also instrumental in achieving customer loyalty.

Navigating the Cost of Acceptance for SMEs

The cost of acceptance encompasses various factors that contribute to the final fee charged to customers during card transactions. This includes merchant service fees imposed by banks or payment processors, as well as any additional operational expenses incurred. For SMEs, understanding this cost is crucial, as it determines the maximum allowable surcharge they can apply to customers. By accurately identifying these fees, businesses can set a surcharge that is compliant with the ACCC’s guidelines and reflects their true costs.

The Reserve Bank of Australia (RBA) plays a significant role in defining what constitutes the cost of acceptance, and SMEs are encouraged to reference updated resources available on the RBA and ACCC websites for guidance. Through diligent calculation and an emphasis on transparency, businesses can ensure they are not only complying with legal standards but also establishing fair pricing practices that enhance customer satisfaction and trust.

ACCC’s Campaign for Educating SMEs on Compliance

The ACCC has initiated a comprehensive educational campaign aimed at enlightening SMEs about the importance of compliance when it comes to card payment surcharges. This campaign includes the release of updated guidelines, collaboration with industry partners, and informative materials that clarify the nuances of the surcharge disclosure regulations. By fostering an environment of understanding and awareness, the ACCC aims to support businesses in navigating the complexities of retail payment regulations.

Moreover, the ACCC encourages SMEs to engage with experts, including their payment processors, accountants, and banks, to accurately assess and report their cost of acceptance. This initiative not only aids in compliance but also helps small businesses make informed decisions regarding their payment strategies. The campaign underscores the ACCC’s commitment to ensuring that SMEs operate within the legal framework while promoting fair treatment of consumers.

Monitoring and Enforcement of Surcharge Compliance by ACCC

The ACCC plays an active role in monitoring the compliance of SMEs with respect to card payment surcharges. This involves not only facilitating education but also taking enforcement action when businesses fail to adhere to the established guidelines. The ACCC’s Compliance and Enforcement Policy outlines the measures it will implement to protect consumers from deceptive practices, which is crucial in maintaining a fair market environment.

By actively scrutinizing surcharge practices, the ACCC seeks to reduce instances of misleading conduct and promote compliance among SMEs. Businesses that neglect to comply with the guidelines risk facing penalties and potential legal consequences. This rigorous oversight encourages all firms, especially SMEs, to keep their surcharge practices transparent and equitable, reinforcing the overall integrity of the retail payment landscape in Australia.

Strategies for SMEs to Avoid Excessive Surcharging

To mitigate the risk of imposing excessive surcharges, SMEs should implement several key strategies. First, they should conduct a thorough review of their cost of acceptance by analyzing their merchant service agreements, transaction fees, and other relevant costs associated with card payments. Understanding the full spectrum of these expenses will enable businesses to establish fair and lawful surcharge rates that comply with ACCC regulations.

Additionally, SMEs should maintain open communication with their customers regarding any surcharges that may apply. Clear signage, informative online checkout processes, and direct communications can all serve to ensure that customers are well-informed before making payments. By adopting these practices, businesses can avoid excessive surcharges and build stronger relationships with their clientele, ultimately enhancing customer trust and loyalty.

Role of Merchant Services in Calculating Costs

Merchant service providers play a pivotal role in determining the cost of acceptance for SMEs. These providers offer the necessary tools and support needed to process card payments effectively while outlining the associated fees. Therefore, it is crucial for businesses to engage with their merchant service providers, asking for detailed breakdowns of costs that will influence their surcharges.

Furthermore, SMEs should evaluate the different merchant service options available to them. By comparing fees and services from various providers, businesses can identify the most economical choice that serves their needs while ensuring compliance with ACCC guidelines. In doing so, SMEs can streamline their operations and enhance their ability to set appropriate surcharges, which reflects their cost of acceptance accurately.

Building Trust Through Transparent Payment Practices

Transparent payment practices are paramount to building trust with customers in the competitive retail landscape. By ensuring that surcharge policies are compliant with ACCC guidelines and by providing full disclosure on additional fees, SMEs can foster a relationship based on honesty and reliability. Customers who feel informed about the costs associated with their payments are more likely to engage in repeat business and recommend the enterprise to others.

Moreover, SMEs should consider implementing customer feedback mechanisms regarding payment practices. Regularly soliciting customer insights can help businesses adapt their surcharge strategies and refine communication methods, ultimately leading to a more positive shopping experience. By prioritizing transparency in payment processes, SMEs not only adhere to regulatory requirements but also strengthen their market position by enhancing customer satisfaction.

Future Prospects of Surcharging Regulations

As the landscape of retail payments continues to evolve, so too will the regulations governing card payment surcharges. The ACCC, in conjunction with the Reserve Bank of Australia, is expected to review and possibly amend current guidelines to reflect advancements in payment technologies and shifts in consumer behavior. SMEs must stay abreast of these changes to maintain compliance and competitiveness in an ever-changing environment.

Looking forward, SMEs are encouraged to proactively participate in discussions about payment regulations and be vocal about their experiences and challenges. Engaging with regulatory bodies and industry associations can help shape more favorable conditions and ensure that the needs of small businesses are addressed. By remaining informed and involved, SMEs can navigate future surcharging regulations with confidence and adaptability.

Frequently Asked Questions

What are card payment surcharges, and how do they relate to SME compliance?

Card payment surcharges are fees that businesses add to transactions made with credit or debit cards. Compliance for small and medium enterprises (SMEs) involves ensuring these surcharges reflect the actual cost of acceptance, which includes merchant service fees and other associated costs. The ACCC mandates that surcharges should not exceed this cost and must be disclosed to customers to avoid misleading pricing.

How do ACCC guidelines influence the imposition of card payment surcharges?

The ACCC guidelines serve as a framework for businesses regarding the implementation of card payment surcharges. These guidelines establish that surcharges must align with the actual cost of acceptance, hence preventing excessive charges. SMEs are required to transparently disclose any surcharges to customers, ensuring compliance with consumer protection laws.

What constitutes excessive card payment surcharges according to retail payment regulations?

Excessive card payment surcharges are defined as any fees that surpass the actual costs incurred by the business for card payment acceptance, known as the cost of acceptance. Retail payment regulations, guided by ACCC standards, prohibit charging customers more than this actual cost, which could lead to potential penalties for noncompliance.

What is the cost of acceptance, and how can SMEs determine it?

The cost of acceptance refers to the total expenses incurred by SMEs for processing card payments, including merchant service fees. Businesses can determine their cost of acceptance by reviewing contracts, statements, or invoices from payment processors or banks. Accurate calculation is crucial to setting compliant card payment surcharges.

Why is it important for SMEs to disclose card payment surcharges to customers?

It is crucial for SMEs to disclose card payment surcharges to ensure transparency and build customer trust. As per ACCC guidelines, failing to inform customers about these fees can be regarded as misleading and could lead to enforcement actions. Clear communication helps maintain a positive relationship with customers and aligns with legal requirements.

What are the potential consequences for SMEs failing to comply with card payment surcharge regulations?

SMEs that fail to comply with card payment surcharge regulations risk facing enforcement actions from the ACCC, including penalties. Noncompliance can also damage their reputation and customer trust, leading to a potential loss of business, as customers may choose to avoid businesses that impose unfair or undisclosed fees.

How can SMEs stay updated on the latest policies regarding card payment surcharges?

SMEs can stay informed about the latest policies and guidelines regarding card payment surcharges by regularly visiting the ACCC and Reserve Bank of Australia (RBA) websites. These platforms provide updated information and resources that help businesses understand their compliance obligations and how to accurately calculate their cost of acceptance.

What resources are available for SMEs to help them with compliance on card payment surcharges?

The ACCC provides a range of resources, including educational materials, guidelines, and workshops aimed at helping SMEs understand their obligations regarding card payment surcharges. Additionally, businesses can consult with their banks, accountants, or business advisors for personalized guidance on evaluating and adapting their surcharging practices.

How will the ACCC monitor compliance among SMEs regarding card payment surcharges?

The ACCC actively monitors compliance by reviewing business practices and may conduct investigations into surcharging behaviors. They may also partner with industry stakeholders to support education and compliance initiatives, ensuring SMEs adhere to the regulations set forth in the Competition and Consumer Act.

What is the impact of the Reserve Bank of Australia’s Review of Retail Payments Regulation on card payment surcharges?

The Reserve Bank of Australia’s Review of Retail Payments Regulation is expected to influence the framework surrounding merchant card payment costs and surcharging by potentially introducing new measures or refining existing guidelines. SMEs should keep an eye on this review to align their practices with any forthcoming changes in regulations.

| Key Point | Details |

|---|---|

| ACCC’s Urging to SMEs | The ACCC is urging SMEs to review their card payment surcharges to ensure compliance. |

| Cost of Acceptance Definition | Surcharges must reflect the actual costs associated with card payments, known as the cost of acceptance. |

| Legal Requirements | Under Australian law, businesses cannot mislead customers about pricing and cannot charge excessive surcharges. |

| Education Campaign by ACCC | ACCC has initiated a campaign to educate SMEs on compliance and correct surcharging practices. |

| Consultation Encouraged | Businesses are encouraged to consult various financial professionals to ascertain their cost of acceptance. |

| Possible Penalties | Non-compliance with surcharge laws can lead to enforcement action by the ACCC. |

| Variability of Surcharges | Since costs of acceptance vary among businesses, surcharges may differ accordingly. |

Summary

Card payment surcharges are a critical aspect of consumer transactions that businesses, especially small and medium enterprises (SMEs), must manage carefully. The Australian Competition and Consumer Commission (ACCC) emphasizes that these surcharges must accurately reflect the genuine costs of accepting card payments. By fully disclosing fees and ensuring compliance with regulatory standards, businesses can avoid misleading customers and reduce the risk of penalties. Therefore, it is essential for SMEs to review and adjust their surcharging practices promptly to maintain transparency and customer trust.